Can Money Buy Happiness?

I stared awestruck out the window, craning to see anything recognizable from my 33,000 foot vantage point.

At 19 years old I was on my first flight ever, en route to Jerusalem.

I began paying for things I needed when I was 12. My odd jobs included babysitting and selling garden produce door to door and eventually teaching piano lessons before I was finally old enough to get an official job.

Unfortunately, being self-employed didn’t really sharpen my entrepreneurial skills; however, it did heighten my sense of valuing how I would spend money. I spent what I had to buy to get by at school, but with the rest of my income, I purchased experiences.

Can money buy happiness? Here’s what I found.

Money, Happiness, and Worth

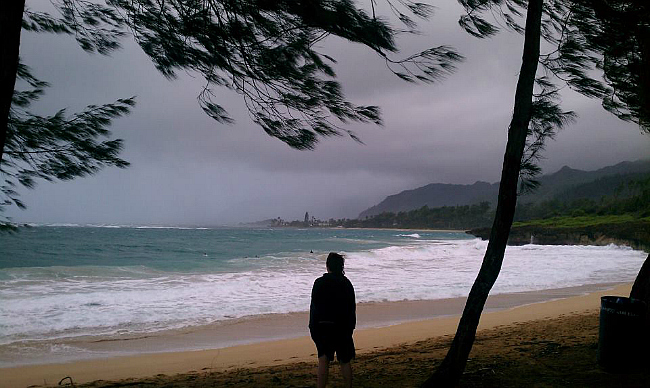

I’ve stood on abandoned castles and windy cliffs, sandy beaches and banyan trees. I’ve watched whales breach and dolphins spin.

I’ve attended family baptisms, baby blessings, weddings and funerals.

I’ve eaten a hamburger in Hamburg, frankfurter in Frankfurt, chili in Chile, and Andes mints in the Andes Mountains.

I sat atop a volcano and watched the sun rise and set. I’ve explored pyramids, and walls, and temples.

Money enabled me to experience all of these things that filled my soul with joy.

My philosophy is that the money gets spent anyway, so we might as well spend it experiencing something!

Wherefore, do not spend money for that which is of no worth, nor your labor for that which cannot satisfy (2 Nephi 9:51).

The adventures that bring me joy may not be the adventures that bring you joy. Isn’t that the great thing about being unique individuals?

So, can money buy happiness?

The Wall Street Journal recently addressed the impact that money–earning, spending, and saving–has on individuals in “Can Money Buy You Happiness?”

Material Goods Versus Experiences

My philosophy values experiences over material goods. But why?

Cornell University psychology professor Thomas Gilovich concluded

“People often make a rational calculation: I have a limited amount of money, and I can either go there, or I can have this,” he says. “If I go there, it’ll be great, but it’ll be done in no time. If I buy this thing, at least I’ll always have it. That is factually true, but not psychologically true. We adapt to our material goods.”

It’s this process of “hedonic adaptation” that makes it so hard to buy happiness through material purchases. The new dress or the fancy car provides a brief thrill, but we soon come to take it for granted.

Experiences, on the other hand, tend to meet more of our underlying psychological needs, says Prof. Gilovich. They’re often shared with other people, giving us a greater sense of connection, and they form a bigger part of our sense of identity. If you’ve climbed in the Himalayas, that’s something you’ll always remember and talk about, long after all your favorite gadgets have gone to the landfill.

And, crucially, we tend not to compare our experiences with other people so much. “Keeping up with the Joneses is much more prominent for material things than for experiential things,” he says. “Imagine you’ve just bought a new computer that you really like, and I show up and say I’ve paid the same amount for one with a brighter monitor and faster processor. How much would that bug you?”

In experiments he’s run, it bugs people a lot. But when people are told to imagine they’ve gone on vacation to New Zealand, and someone else has had a slightly better vacation, “it bothers people somewhat, but you still have your own experiences and your own memories, and so it tends to trouble you less.”

I hadn’t ever considered why the quantified impact of purchasing material things versus experiential things was so different.

But, most people I know feel like their family’s Disney vacation was priceless, or talk about their cruise for months. People talk more enthusiastically about movies they’ve seen than clothes they wear.

I feel like I’ve helped my dad learn to value money spent on experiences. He worked so hard throughout his life to purchase the basic essentials for our large family. He definitely saw the value of spending money on something that lasted and could be used indefinitely.

He disagreed with the way I spent some of my money, but respected my choice to do so.

Over the years, he has chosen to purchase an experience when he otherwise wouldn’t (like when he and mom came to visit me and my husband while we lived in Hawaii).

Dad and I recently shared a “frivolous” experience to cross something off of my bucket list: a fan boat ride. It was kind of expensive and I worried that it wouldn’t be worth it to him.

But, my husband, parents and I had a blast cruising the shallow waters of Mobile Bay watching alligators, birds, and plant life. We still talk about the alligator that swam up and hung out by the boat.

If you haven’t tried it yet, give yourself permission to buy experiences at least once!

Another important element I consider when spending money is time. Time is my most important commodity.

How will the money spent affect my time?

My husband commuted at least an hour to and from work. We decided to move closer to his work and now pay more for living expenses, but enjoy the benefits of a seven minute commute, and a much happier husband.

Of course, we all ultimately still need to live within our means, purchase essentials, and use discernment when using discretionary funds for material or experiential things.

Opportunities for credit and “get it now” abound. But, generally, a creditor’s money does not buy our happiness. Instead, we just find ourselves in debt’s stressful bondage.

Manage Your Money and Get Out of Debt

Going into debt for experiential experiences or material things deflates the positive effect of the experience or thing.

I immediately think of Christmas debt. It’s great to give nice gifts, but shock and stress awaiting in January’s mailbox’s diminishes the merriness and brightness of the gift.

Managing your money as you set a budget enables you to spend money wisely and avoid shopping blues.

We’ve been repeatedly counseled by the Lord and His inspired servants to get out of debt and stay out of debt as a way to increase personal happiness.

Verily I say unto you, concerning your debts—behold it is my will that you shall pay all your debts (Doctrine and Covenants 104:78). Pay the debt thou hast contracted. … Release thyself from bondage (Doctrine and Covenants 19:35).

President Heber J. Grant emphasized the impact of managing money as you establish a budget.

If there is any one thing that will bring peace and contentment into the human heart, and into the family, it is to live within our means, and if there is any one thing that is grinding, and discouraging and disheartening it is to have debts and obligations that one cannot meet (Relief Society Magazine, May 1932, p. 302).

Elder Franklin D. Richards recommended ways to find happiness through financial freedom.

What a blessing it is to be free from financial fear. I would like to suggest a three-point formula to attain and maintain financial preparedness:

- Pay your tithes and offerings.

- Get out of debt and stay out of debt.

- Use your surplus funds wisely.

In getting out of debt and staying out of debt, there are certain basic principles that we, as individuals and families, can apply, such as:

- Live within your income.

- Prepare and use short- and long-term budgets.

- Regularly save a part of your income.

- Use your credit wisely, if it is necessary to use it at all. For example, a reasonable debt may be justified for the acquisition of a home or education.

- Preserve and utilize your assets through appropriate tax and estate planning.

In “Earthly Debts, Heavenly Debts,” Elder Joseph B. Wirthlin warned,

Remember this: debt is a form of bondage. It is a financial termite. When we make purchases on credit, they give us only an illusion of prosperity. We think we own things, but the reality is, our things own us.

In the midst of debt’s crushing blows, gratitude for what one has provides the hope to believe in a brighter, freer future.

An Attitude of Gratitude

Aldous Huxley observed that “Most human beings have an almost infinite capacity for taking things for granted.”

To combat taking everything for granted, the Lord basically commands us to foster an attitude of gratitude.

And in nothing doth man offend God, or against none is his wrath kindled, save those who confess not his hand in all things, and obey not his commandments (Doctrine and Covenants 59:21).

How can gratitude make a difference in our fiscal lives?

“Can Money Buy You Happiness?” suggests that gratitude allows us to consciously value everything we have.

“Human beings are remarkably good at getting used to changes in their lives, especially positive changes,” says Sonja Lyubomirsky, psychology professor at the University of California, Riverside.

If you have a rise in income, it gives you a boost, but then your aspirations rise too. Maybe you buy a bigger home in a new neighborhood, and so your neighbors are richer, and you start wanting even more. You’ve stepped on the hedonic treadmill. Trying to prevent that or slow it down is really a challenge.”

She recommends cultivating feelings of gratitude to consciously value what you do have.

It could be as simple as setting aside time every day to follow the traditional advice of “counting your blessings.” Or you might want to keep a daily journal or express your gratitude to other people. The key is to find a way to remain conscious of everything you own and avoid simply adapting to having it around.”

President Henry B. Eyring recalled how he developed an attitude of gratitude as he looked for and remembered God’s hand in his daily life.

“I wrote down a few lines every day for years. I never missed a day no matter how tired I was or how early I would have to start the next day.

Before I would write, I would ponder this question: “Have I seen the hand of God reaching out to touch us or our children or our family today?”

As I kept at it, something began to happen. As I would cast my mind over the day, I would see evidence of what God had done for one of us that I had not recognized in the busy moments of the day.

As that happened, and it happened often, I realized that trying to remember had allowed God to show me what He had done.

More than gratitude began to grow in my heart.”

Gratitude gives way to the happiness paradox of money: giving. Study after study concluded that people’s giving away money to others rather than spending it only on themselves increased happiness.

The Attribute of Donating Money

Give, and it shall be given unto you; good measure, pressed down, and shaken together, and running over, shall men give into your bosom. For with the same measure that ye mete withal it shall be measured to you again (Luke 6:38).

Have you felt the “good measure, pressed down, and shaken together and running over” in your life?

“Can Money Buy You Happiness?” suggests sharing our financial resources with others, now rather than later.

Donate your money!

“A lot of us think we’ll give to charity one day, when we’re richer, but actually we see the benefits of giving even among people who are struggling to meet their own basic needs.”

What moves the needle in terms of happiness is not so much the dollar amount you give…but the perceived impact of your donation. If you can see your money making a difference in other people’s lives, it will make you happy even if the amount you gave was quite small.”

The Lord has made sharing easy through tithing, fast offerings and other donations through the Church and clearly identifies the impact of those donations.

Elder Jeffrey R. Holland reminded us of God’s promises as we give.

“[B]e as generous as circumstances permit in your fast offering and other humanitarian, educational, and missionary contributions.

I promise that God will be generous to you, and those who find relief at your hand will call your name blessed forever.”

In addition to tithes and offerings, there are so many ways to donate money to others.

We can find a cause or impact that speaks uniquely to our happiness meter.

The Lord considers us abundantly blessed–so blessed that we can give money away.

“Therefore, if any man shall take of the abundance which I have made, and impart not his portion, according to the law of my gospel, unto the poor and the needy, he shall, with the wicked, lift up his eyes in hell, being in torment” (Doctrine and Covenants 104:18).

Money As a Means to An End

In the passage before the hell and torment warning for the greedy and selfish, the Lord sets forth His vision for man’s abundance

For it is expedient that I, the Lord, should make every man accountable, as a steward over earthly blessings, which I have made and prepared for my creatures. I, the Lord, stretched out the heavens, and built the earth, my very handiwork; and all things therein are mine.

And it is my purpose to provide for my saints, for all things are mine.

But it must needs be done in mine own way; and behold this is the way that I, the Lord, have decreed to provide for my saints, that the poor shall be exalted, in that the rich are made low.

For the earth is full, and there is enough and to spare; yea, I prepared all things, and have given unto the children of men to be agents unto themselves (Doctrine and Covenants 104:13-17).

The Savior told His disciples,

I am come that they might have life, and that they might have it more abundantly (John 10:10).

The early saints were taught that

[A]ll things which come of the earth, in the season thereof, are made for the benefit and the use of man, both to please the eye and to gladden the heart (Doctrine and Covenants 59:18).

Money, this earthly resource, when used with wisdom creates stability and a freedom to spend time hastening the Lord’s work. So the positive relationship between your money and happiness can potentially blossom and flourish.

“[M]en are, that they might have joy” (2 Nephi 2:25) and money is a tool provided by a loving Heavenly Father that when properly used helps us to create happiness for ourselves and others.