LDS Church Tax Practices Under Fire … For No Apparent Reason

There’s a new YouTube video, picked up by various news sources, that directly attacks The Church of Jesus Christ of Latter-day Saints for land it intends to develop in Hawaii, and questions the Church’s tax practices.

A local woman acts as the spokesperson in the ad, in which she airs her grievances with the Church.

You can view the commercial here if you’d like. This article simply rebuts the claims made in the video.

Does the Mormon Church pay taxes?

Good question. Tax policy, when it comes to religious organizations or any 501(c)(3) organizations that have an element of for-profit business involved, is complicated. Here’s what President Gordon B. Hinckley said in General Conference back in 1991:

I repeat, the combined income from all of these business interests is relatively small and would not keep the Church going for longer than a very brief period. I add, also, that these commercial properties are tax-paying entities who meet their tax obligations under the laws of the areas where they are located.

Again, all such commercial properties are taxed under the government entities where they are located. Not only do they pay property taxes, but also income taxes on any profits. So it is with all of the commercial operations of the Church.

The commercial complains that the Church doesn’t appear to be paying their fair share of taxes in Laie, Hawaii.

We’re presented with two sources. One source (the commercial) has very little access to any tax information of the Church whatsoever (if it did, it would have been presented as convincing evidence in the commercial).

The second source (the President of the Church) has unlimited access to Church tax information and assures that the Church does indeed pay taxes. At this point, it’s their word against his. You can be the judge.

It is curious that the creators of the video are trying to drum up public support for an issue that one would think would be addresses legally, especially with the accusation of fraud.

What tax information is available to the public?

The U.S. government is wary of 501(c)(3) organizations that try to take advantage of their tax-exempt status. As such, these organizations fill out the Internal Revenue Service (I.R.S.) Form 990. Here’s a couple of links to the Polynesian Cultural Center’s Form 990 from 2014 and from 2015 (the most recent statements readily available).

As you’ll see in the statements (or on this summary page here), in 2014 the PCC lost almost 7.5 million dollars in net income. In 2015 the PCC was in the black at about 12.5 million dollars.

But no matter how large or small the net income sum from a 501(c)(3) entity, it has to be applied back into the organization or distributed to charitable causes, which is exactly what the PCC claims to do on their website:

100 percent of PCC’s revenue goes to daily operations and financial assistance to nearly 17,000 young students over the last 48 years from more than 70 different countries throughout the Pacific while they attend Brigham Young University-Hawaii.

Is the LDS Church a business or a religion?

Businesses and religious organizations operate under very different tax laws. Some people claim that the LDS Church’s business interests extend far beyond its religious interests, and should therefore pay taxes as a business entity.

It’s true that the Church does have business interests and entities, and that branch of the Church does pay taxes as business organizations. Deseret Management Corporation manages the Church’s for-profit entities, including Hawaii Reserves Inc., which owns the land in question in the commercial.

For plenty more information on this subject, check out this article.

Why does the Church own so much?

It’s true that the Church owns a lot of land in Laie. There’s nothing wrong with that. Brigham Young University alone takes up a sizable chunk. The Church owns a lot of land in a lot of places. They’ve been developing land since the early years of the restoration of the Church (exhibit A: Nauvoo, Illinois).

More recently, the Church has talked about developing on a huge Church-owned ranch in Florida. They’ve also helped development to occur at City Creek Center in Salt Lake City. They own City Creek land, but lease it to a separate organization which owns the shopping center.

The Church has stated that “the commercial businesses owned by the Church help serve the needs of the Church in accomplishing its mission.”

And they own a lot more than land. TV/radio channels, farms, orchards, a hotel and even utility companies (including the company that provides water to all of Laie). All of these entities serve to further the mission of the Church in terms of finance, communication, humanitarian resources, etc.

Do other churches own and develop land?

Yes. It’s not just the Mormons. It’s fairly common for churches everywhere to develop real estate for a variety of reasons. This article, for example, mentions just a few examples of development orchestrated by different churches in Australia.

This Washington Post article comments on an apartment complex in Maryland developed by, you guessed it, a church. Affordable housing seems to be a common trend when it comes to church-owned real estate (which is largely what the LDS Church plans on doing in Laie). They have their reasons, and we’d do well to give these organizations the benefit of the doubt, rather than jumping to corruption-laced conclusions.

Does the Church own the land in question?

If you choose to watch the commercial, you’ll find that land ownership is called into question. But, as it turns out, land ownership is public information. All it takes to resolve this doubt is a Google search.

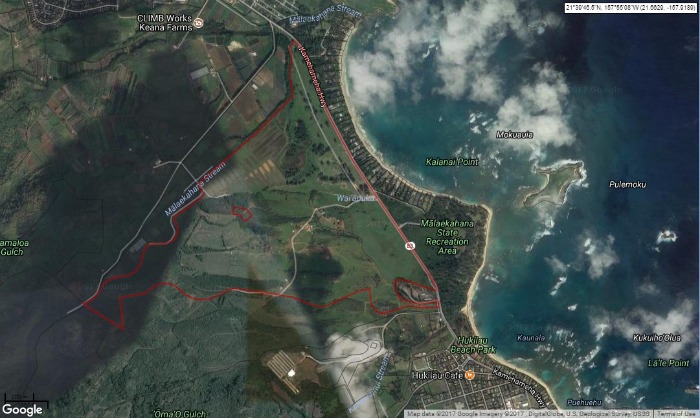

Below is a screenshot from a public records website of the plot of land in Laie that the Church is planning to build on.

According to the website, the owner of that land parcel is Property Reserve Inc. Who is Property Reserve Inc.? According to Bloomberg.com, “Property Reserve, Inc. operates as a subsidiary of The Church Of Jesus Christ Of Latter-Day Saints.” It’s the Church’s land.

The Church also owns the plot directly under the selected land on the map, and the small plot (outlined in red) within the larger plot of land.

Grasping at straws

It’s unfortunate that some people find the Church’s endeavors to be inconvenient.

This is not the first, nor will it be the last time that people and groups will attempt to damage the Church by claiming fiduciary illegalities and improprieties. It will not be the last time that the preferred tactic is public support rather thann legal action. It is also not the last time that the Church, its leadership and members will be attacked in creative ways as in this bizarre attempt to summon President Monson to a British court.

The video in question may gain some sporadic traction for a time, but should have no direct impact on PPC operations nor church plans to develop purchased property.