Is Your Financial House in Order? A Simple Checklist for Latter-day Saint Families

In a memorable General Conference address in October 1998, President Gordon B. Hinckley advised members of The Church of Jesus Christ of Latter-day Saints around the world that “the time has come to get our houses in order.” In the years since President Hinckley’s remarks, the United States has endured two economic recessions, including the most severe recession of the post-World-War-II era. But did you realize that in every decade since the 1930s, the U.S. has experienced at least one and in some cases two recessions? When difficult financial or economic conditions arise, having your financial house in order will allow your family to weather the storm.

Below is a simple checklist to help you asses whether your family’s financial house is in order:

1. Is your total debt-to-income ratio below 35%?

Your debt-to-income ratio refers to the portion of your gross monthly income that you must use to stay current in paying off your debts. Ideally, no more than 25% of your monthly income should be used for a mortgage, and your total debt-to-income ratio should be 35% or less. If the amount you pay toward your debts monthly is higher than 35%, it’s a good sign you have taken on too much debt, which means your financial house could be on shaky ground.

2. Do you have enough term life insurance to protect your family?

Life insurance can be confusing, but it is an important component of having your financial house in order. Term life insurance refers to the type of life insurance that covers a policyholder for a specified “term” (e.g., 20 years) and pays a death benefit only if the policyholder dies during the specified term. For example, you could purchase a term life insurance policy that pays out $1 million if you die during the next 30 years of your life. If you live beyond the specified term, the insurance company does not pay any benefit. Term life insurance is inexpensive and can provide your family with peace of mind from knowing that your family’s financial obligations can be covered, even if the primary breadwinner in the family dies unexpectedly. My personal suggestion is to avoid permanent life insurance (including universal and whole life insurance), because the associated fees and commissions are usually expensive, and because the investment portion generally underperforms other investment options. If you are the primary provider in your family, use a term life insurance policy to ensure your spouse could pay the mortgage, your children’s future education costs, and other essential expenses if you unexpectedly pass away.

3. Do you live on less than 80% of your monthly income?

One of the best signs that your financial house is in order is the ability to consistently live on less than 80% of your gross monthly income. The idea is that you pay 10% of your monthly income to tithing, and you save at least another 10%. An emergency fund should be included in those savings. Living below your means will teach you to be disciplined with your spending, and it will allow you to build up the financial reserves you might one day need in the event of unexpected financial challenges.

4. Do you save consistently for retirement?

Several recent surveys have confirmed (once again) that many Americans have very little or no savings for retirement. According to one survey, nearly 30% of working Americans have less than $1000 in retirement savings. Chances are you will need more savings for retirement than you think you’ll need. The ability to live comfortably and do the things we often envision during retirement—serving missions, traveling, etc.—requires careful planning and consistent saving over a long period of time. Start saving for retirement as early as possible. Maximize your contributions to employer-sponsored retirement plans that include employer matching (e.g., 401(k) or 403(b)), or if you don’t have access to an employer-sponsored retirement plan, take advantage of the tax savings available if you save for retirement using a Roth or traditional IRA.

5. Do you pay off your credit card(s) in full every month?

Carrying a balance on a credit card is a telltale sign that your financial house is not in order. Simply put, the interest rates on most credit cards are high enough that carrying a balance is extremely costly and can eventually become crippling. Note, however, that if you have the discipline to use a credit card wisely and pay off the balance in full each month, you can use some credit cards to earn valuable rewards.

6. Have you prepared a basic legal will for your family?

Similar to term life insurance, having a basic legal will prepared for your family is an important step to having your financial house in order. Especially if you have children, you need a will that establishes who will care for your children if you and your spouse die unexpectedly, how you want your estate to be taken care of, and who will administer any assets you leave behind for minor children. Preparing a will does not need to be expensive—you may be able to obtain basic templates online, but check to make sure they are valid in your state. After my wife and I had our first child, we decided to prepare a will and learned that the university where I was enrolled in graduate school provided free, basic legal services for students. Our first will didn’t cost us anything! Since that time, we have used an attorney to help us update our will to reflect more current information about our family and our assets.

7. Do you save money in advance for family travel or vacations?

Most families enjoy traveling or vacationing together because creating memories together as a family can be very fun and worthwhile. However, using credit-card debt to finance family travel is a costly mistake. If you cannot afford the trip you want to do with your family right now, choose a more modest vacation this time and begin saving now until you can afford other vacations your family wants to take. Remember: save first, then travel.

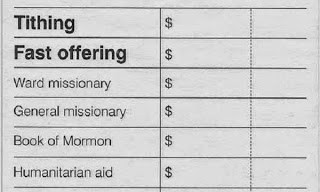

8. Are you generous in your payments of free-will offerings, especially fast offerings?

The free-will offerings we can make to the Church are a wonderful way to help us keep our financial priorities straight. These contributions bless the lives of people in need around the world and bless us, too, in numerous ways. When our financial house is not in order, we may feel like we cannot contribute generously to free-will offerings. Making these contributions a priority in our lives will help us to keep our houses in order.

9. Have you cut wasteful spending habits?

Many people who struggle to get their financial house in order eventually realize that wasteful spending is at the root of their problems. The areas that are most often problematic are also purely discretionary, like expenses for smart phones, TV, eating out, and cars that are too expensive. None of these expenses is essential, and eliminating wasteful spending can go a long ways toward helping you get your financial house in order.

10. Does your family avoid excessive student debt during college?

Student debt in the U.S. has skyrocketed in recent years, with college students borrowing more and more money than ever before. The rise in student debt is partially attributable to rising education costs, but it can also be traced to wasteful and unwise borrowing by students with increasingly easy access to student loans. Although some college programs are certainly more expensive than others—particularly graduate programs—student debt should be kept as modest as possible. Taking on excessive student debt during an undergraduate program is not wise and could burden your family for years with student debt repayment obligations.